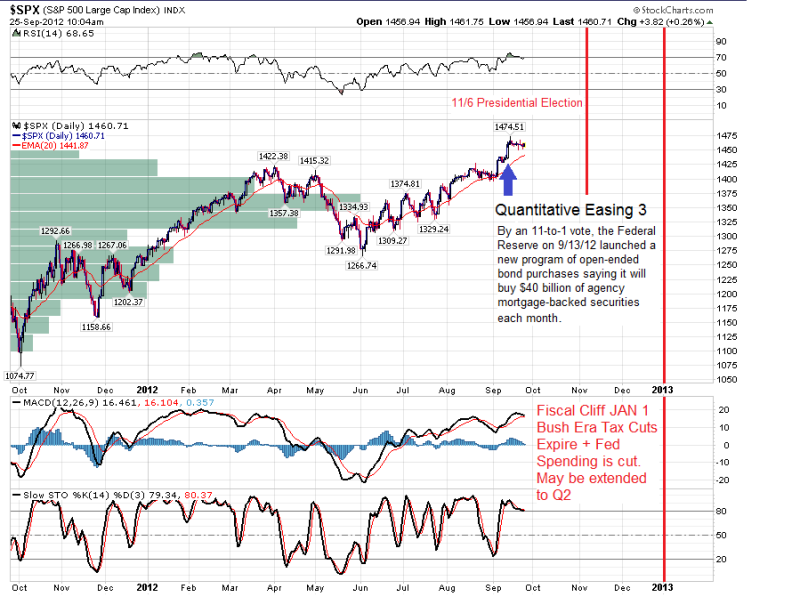

NOV 6: A liberal Democratic POTUS + Congress should suggest an increased economic policy bias toward socialistic "redistribution of wealth through increased taxation", which the Bush era tax cut expiration (tax reversionist normalization) should achieve, thus devaluing the $USD = increasing the $SPX.

JAN 1: However, the mandated Fed spending cuts would strengthen the $USD = decreasing the $SPX.

Two steps forward. Two steps back. But this is in a closed system.

Globally, Spain & Greece seem to be stonewalling ECB efforts to keep the EU on the road to recovery, plus China is exhibiting notable growth slowdowns.

Super Bear says "fuhgedaboudit."

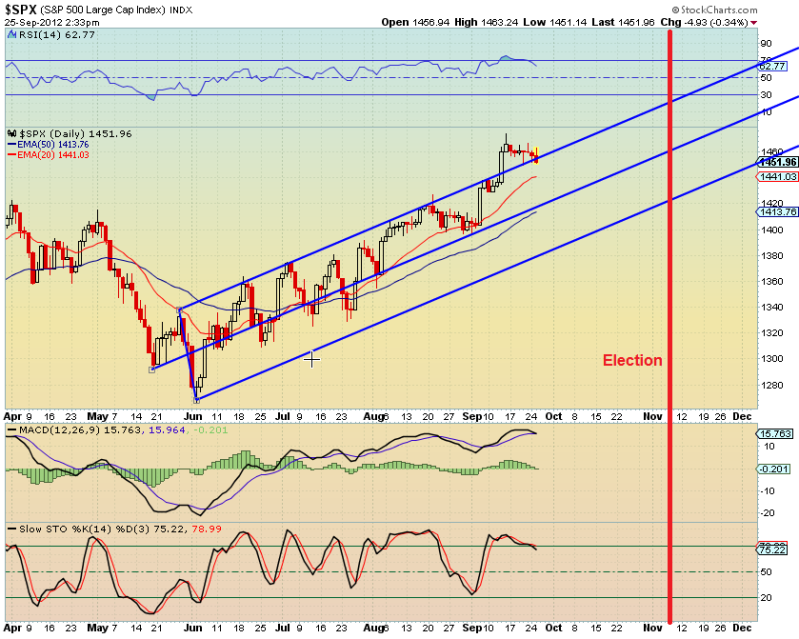

Same Super Bear says a 20-25% SPX drop before election is possible.

Using a $VIX "low testing" approach is not always reliable.

Sometimes the $SPX chugs right along upward when the $VIX bottoms.

Sometimes it doesn't.

Technically - the $VIX is double-bottoming and likely to spike = $SPX to drop, but will the drop be more than the 09/13 QE3 offset spike?

Only if the EU & China both have significant problems - or fear of problems - should the $SPX drop.

SEP 24, later that day: Greece needs more time to fix finances

At $USD technical bottoms,

but the $SPX unreliably operates in the inverse of those.

$GOLD, @ technical high, is estimated to spike to >$2,000 in the event the fiscal cliff forces both tax reversion and spending cuts.

60 day Prediction: Not much