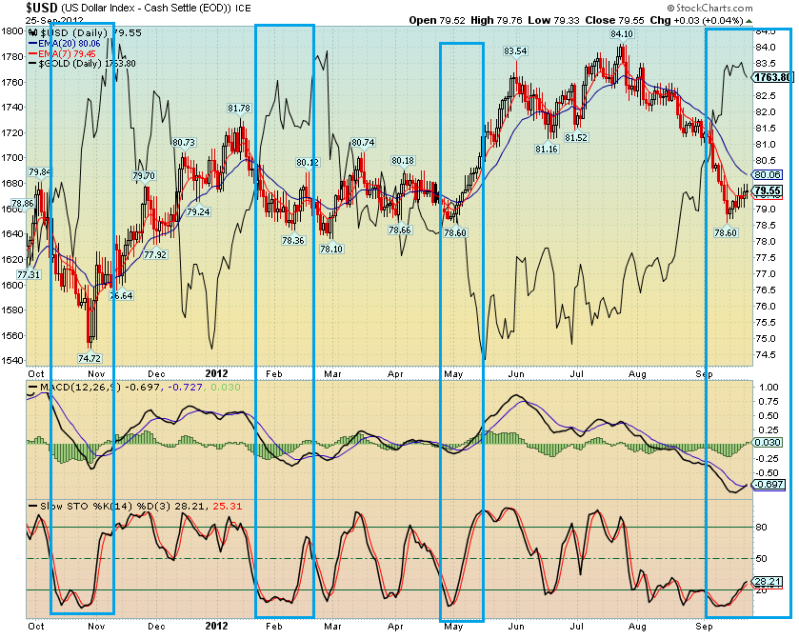

$GOLD: http://stockcharts.com/h-sc/ui?s=$GOLD&p=D&yr=0&mn=6&dy=0&id=p67833494223

Gold climbs with ECB, U.S. fiscal cliff in focus

http://www.marketwatch.com/story/gold-recoups-but-broader-metals-sector-mixed-2012-11-08

Europe dominated the news Thursday “with the [European Central Bank] keeping accommodative policy in place and rates steady,” said Jeffrey Wright, a managing director at Global Hunter Securities. “ECB policies, much like our own, eventually lead to inflation, which support gold.”

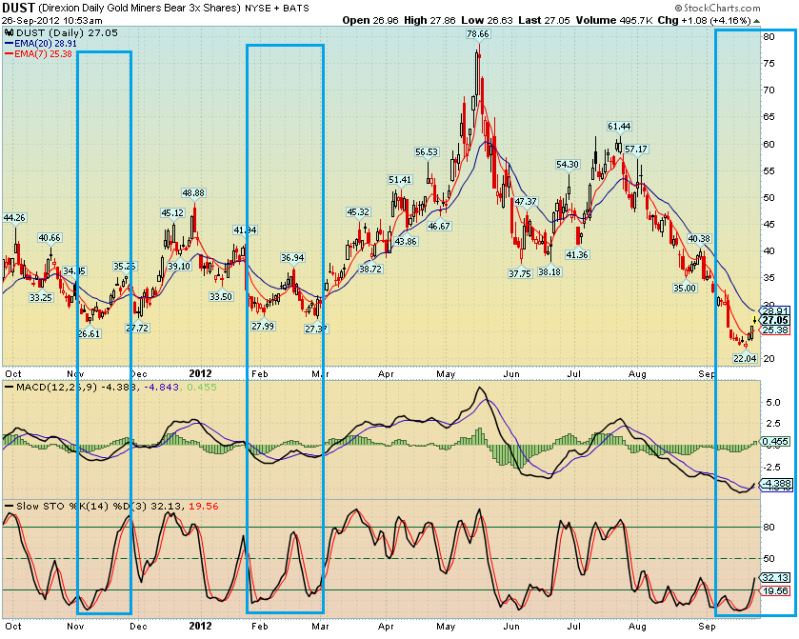

For now, there are three near-term catalysts that should be supportive for gold, said Wright:

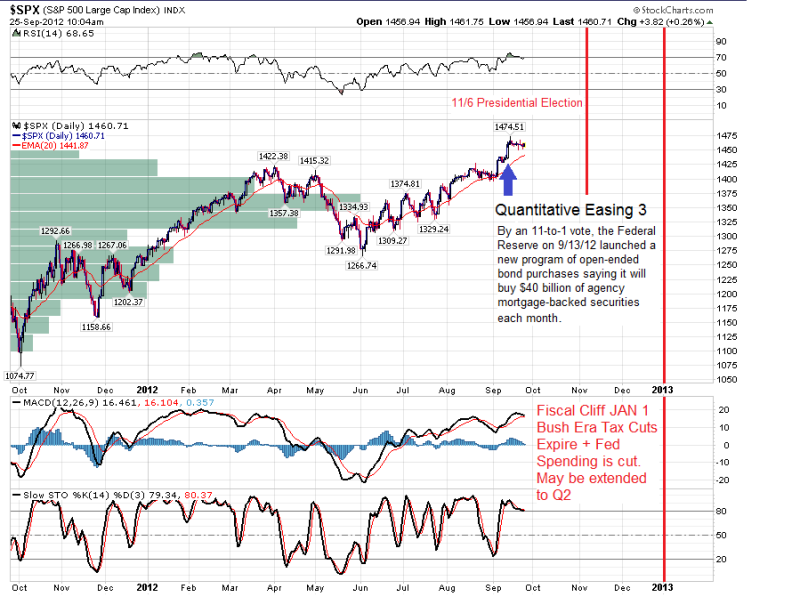

- a U.S. debt-ceiling limit by mid-December,

- a plan to deal with the fiscal cliff before January and

- the Federal Reserve meeting in December which holds the “potential to again support or extend quantitative-easing measures.”

The fiscal cliff refers to a combination of tax hikes and spending cuts that will come into effect on Jan. 1 unless politicians reach a budget deal. If an agreement can’t be reached, the U.S. economy faces roughly $400 billion in tax increases and about $200 billion in spending cuts.